Ukraine crisis briefing

Powered by

Download GlobalData’s Ukraine Crisis Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 16 November

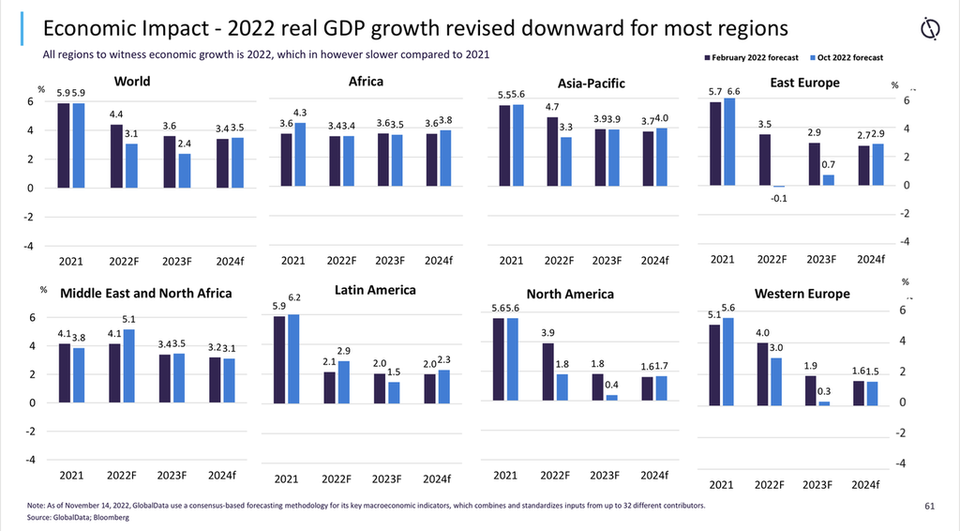

The outlook for global growth continues to deteriorate as inflation continues to creep upwards, despite some easing in commodity and oil prices in recent months. Against this backdrop, GlobalData now forecasts the world economy will grow at just 3.1% in 2022, down sharply from the 5.9% growth in 2021. At the same time, the global inflation rate is now projected to rise to 8.4% in 2022 from 3.5% in the previous year, up from 8% in the last report. TS Lombard expects a recession in the US in 2023, and while much of the recent focus has been on the challenges facing the UK, the eurozone area is just as exposed, if not more so.

There is evidence that western companies are increasingly taking longer-term strategic decisions about pulling out of Russia altogether as packaging demand and confidence evaporate. Mondi has announced it will sell its largest Russian plant for US$1.5bn. Tetra Pak has also declared it would exit its remaining operations after 62 years in Russia; Huhtamaki recently sold its Russian operations to Espetina; and Amcor has announced it will sell three Russian facilities by the end of 2023.

In addition, rapidly rising input prices in Europe and elsewhere are beginning to have a significant impact on all packaging materials from paper and board to steel/aluminium, plastics and glass, threatening the economic viability of production that may lead to some shutdowns and shortages over the winter of 2022/23. This in turn would lead to further supply constraint and higher prices.

- PACKAGING SECTOR IMPACT -

Latest update: 16 November

Supply chain and demand disruption

Glass packager, Vetropack, has cut 400 jobs at its Hostomel factory that was damaged by fighting. It has announced that approximately two thirds of the 600 staff will be lost, though it has no plans to permanently close the site.

Companies leaving Russia

Tetra Pak is the latest high-profile company to announce its departure from Russia. It claims that increasing restrictions on Western exports to Russia have led to unsustainability in the supply chain. Mondi will also sell its Syktyvkar mill for US$1.5bn as it reduces its exposure to Russia. The Syktyvkar mill is one of the biggest suppliers of uncoated fine paper and containerboard to the domestic market. Other more recent sells offs and exits include Huhtamaki and Amcor.